“Oregon Rebate” Measure 118 Could Turn Out To Be A Financial Burden

Measure 118, the controversial measure on the Oregon ballot on November 5 and named the “Oregon Rebate” by proponents, seeks to raise corporate taxes to give every Oregon resident, children included, $1,600 per year. Opponents say it will be an expensive burden.

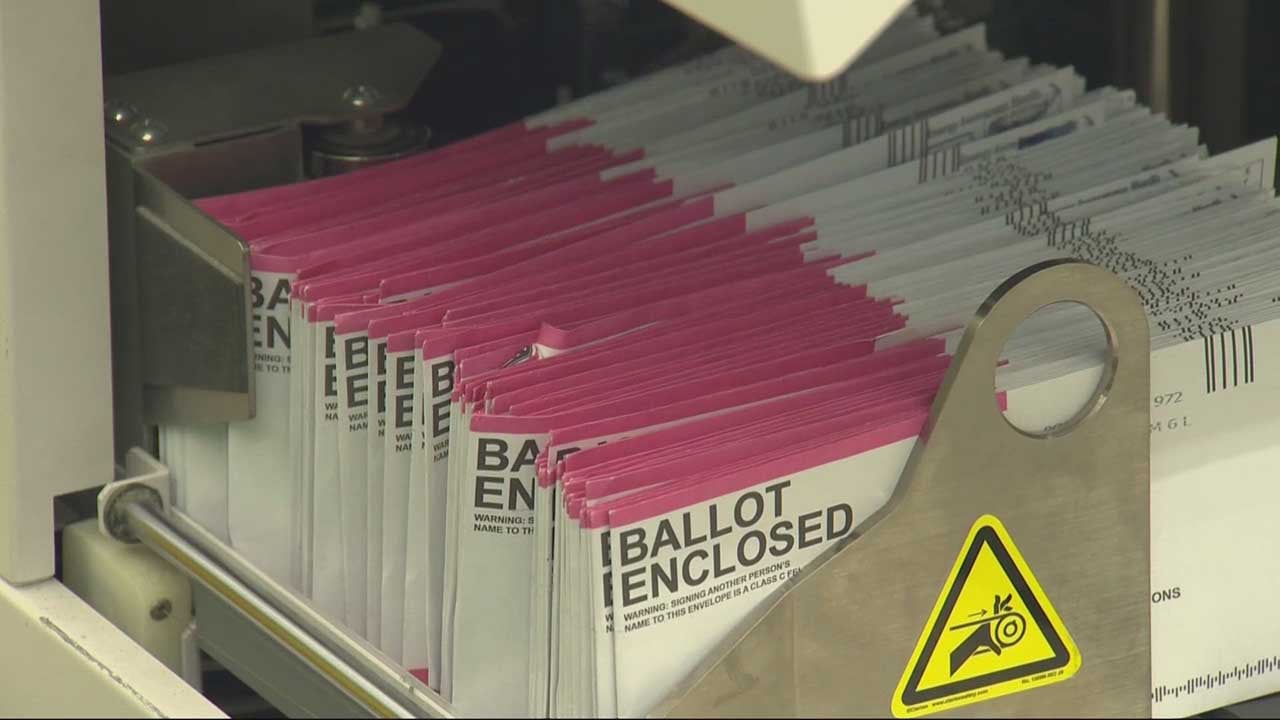

Oregon Measure 118 Ballot

Oregon’s Measure 118 proposes that the corporate minimum tax on sales exceeding $25 million be raised by 3%.

The Oregon Department of Revenue said this would raise an additional $7 billion per year. Measure 118 provides the option to not take the tax credit or a check if the rebate is more than what is owed in taxes.

The revenue would be distributed yearly equally among all Oregonians. It could help with paying bills, childcare, and emergency needs and is similar to the federal money disbursed during the pandemic.

But opponents say the tax will be passed along and consumers will ultimately pay higher prices. It could also affect state budgets for expenses such as education and social services.

Large corporations, labor unions, and most legislative leaders on both sides have come out against the measure. Oregon Governor Tina Kotek is also opposed to the measure. Jody Wiser, of Tax Fairness Oregon, said it doesn’t make any sense when there are all sorts of other needs.

Stacey Rutland of the Yes on 118 campaign who will broadcast further ads this week said, “We’re getting a family of four $6,400 to be able to make sure that they are able to do much better.”